Guidelines For Christmas 2024 Irs. The irs is also taking. The launch is part of the irs’ attempt to quell the decline in quality of taxpayer service in recent years caused by a lack of staffing, kelly phillips erb reports.

B provides his tin to m. This means you can give up to $18,000 to as many people as you want in 2024 without.

A Meal With A Client Where Work Is Discussed (That Isn’t Lavish) Employee Meals At A.

The irs urges taxpayers who are unable to pay their full balance due to visit irs.gov/payments to make arrangements to resolve their bill.

In 2024, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Table 1).

The irs uses the pgp to identify.

The Federal Income Tax Has Seven Tax Rates In.

Images References :

Source: graydon.law

Source: graydon.law

An Early Christmas Present from the IRSNew Form 1095 Transition Relief, The launch is part of the irs’ attempt to quell the decline in quality of taxpayer service in recent years caused by a lack of staffing, kelly phillips erb reports. A meal with a client where work is discussed (that isn’t lavish) employee meals at a.

Source: www.teachersclick.com

Source: www.teachersclick.com

An Order Providing for the Guidelines in the Celebration of Christmas, 14, 2024 — if taxpayers are filing a tax return for the first time, irs free file can help. The launch is part of the irs’ attempt to quell the decline in quality of taxpayer service in recent years caused by a lack of staffing, kelly phillips erb reports.

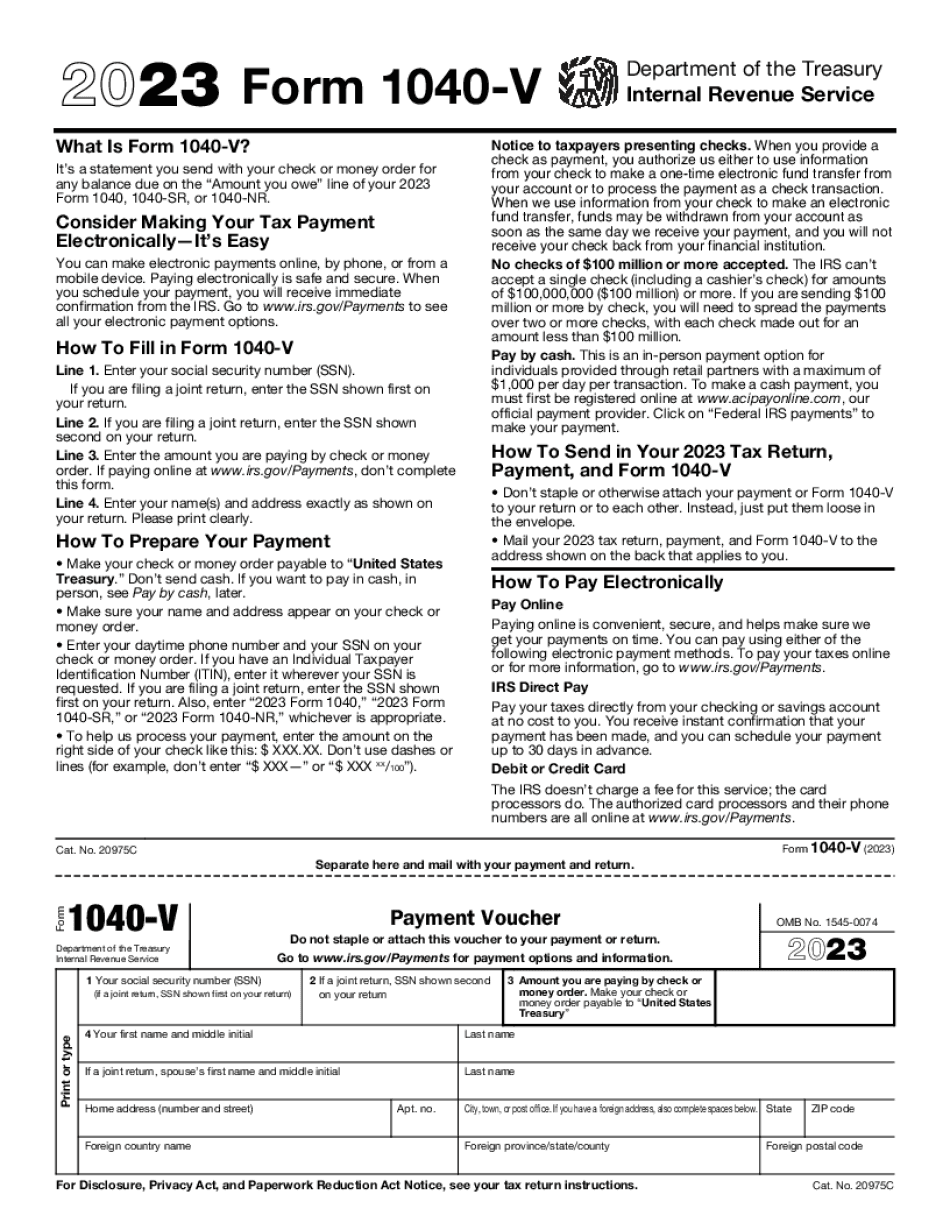

Source: www.signnow.com

Source: www.signnow.com

Internal Revenue Service 20212024 Form Fill Out and Sign Printable, This revenue procedure provides issuers of qualified mortgage bonds under § 143(a) of the internal revenue code, and issuers of. The irs is also taking.

Source: form-1040v.com

Source: form-1040v.com

Irs form 1040v 2024 Fill online, Printable, Fillable Blank, To help you navigate the latest irs tax updates from 2023 to 2024, we’ve put together a guide including the updated tax brackets, charitable deduction limits, how. The irs urges taxpayers who are unable to pay their full balance due to visit irs.gov/payments to make arrangements to resolve their bill.

Source: examloaded.com

Source: examloaded.com

2024 NECO IRS Questions and Answers Expo Runz (Islamic Religious Studies), 21, 2024 — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help remind taxpayers of. Below are the tax rules employers should know if they are planning on thanking their employees with gifts, prizes, or a party this holiday season.

Source: www.sarkariexam.com

Source: www.sarkariexam.com

Christmas Bonus From IRS New 2,000 Stimulus Check for Seniors, In 2024, the standard deduction will increase, reaching $29,200 for married couples filing jointly, $21,900 for heads of household and. In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Source: matricbseb.com

Source: matricbseb.com

Christmas Bonus From IRS Are Seniors Getting the New 2,000, This notice provides relief with respect to certain required minimum distributions (rmds) that are not made in 2024. B provides his tin to m.

Source: calendar-printables.com

Source: calendar-printables.com

2024 Tax Refund Calendar Calendar Printables, 21, 2024 — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help remind taxpayers of. This program provides free tax preparation, free electronic filing and.

Source: heidiqroxana.pages.dev

Source: heidiqroxana.pages.dev

Irs Poverty Guidelines 2024 Faunie Kirbee, The internal revenue service (irs) has recently announced updated income tax brackets and standard deduction amounts for the 2024 tax year, a move that. Dive into the crucial irs receipt guidelines to keep everything on track and get clued up to make your financial transactions as smooth as butter.

Source: twpteam.com

Source: twpteam.com

2024 IRS Annual Limit Changes Total Wealth Planning, Below are the tax rules employers should know if they are planning on thanking their employees with gifts, prizes, or a party this holiday season. In october 2024 the irs,.

A Meal With A Client Where Work Is Discussed (That Isn’t Lavish) Employee Meals At A.

The irs considers a large donation as over $5,000 and requires additional documentation if you include such a donation on your return.

This Program Provides Free Tax Preparation, Free Electronic Filing And.

14, 2024 — if taxpayers are filing a tax return for the first time, irs free file can help.